Although drug supply is a key factor, we posit that

the crisis is fundamentally fueled by economic and social upheaval, its etiology closely linked to the role of opioids as a refuge from physical and psychological trauma, concentrated disadvantage, isolation, and hopelessness...By ignoring the underlying drivers of drug consumption, current interventions are aggravating its trajectory.

There are intuitive causal connections between poor health and structural factors such as poverty, lack of opportunity, and substandard living and working conditions.

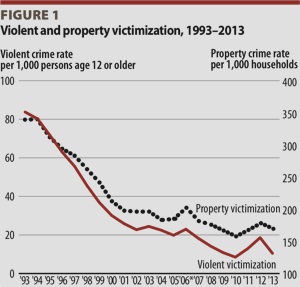

One powerful line of structural analysis focuses on “diseases of despair,” referring to the interconnected trends in fatal drug overdose, alcohol-related disease, and suicide. Since 1999, age-specific mortality attributed to these conditions has seen an extraordinary rise.

The trend is especially pronounced among middle-aged Whites without a college degree, who are now dying earlier on average than did their parents—

which is anomalous outside of wartime.

In an analysis focused on the Midwest, Appalachia, and New England (where the heroin, fentanyl, and both co-mingled epidemics are most pronounced),

combined mortality rates for diseases of despair increased as county economic distress worsened.

The unprecedented 20-year difference in life expectancy between the healthiest and least healthy counties is largely explained by socioeconomic factors...

These indicators are the most recent evidence of a

long-term process of decline: a

multi-decade rise in income inequality and economic shocks stemming from deindustrialization and social safety net cuts.The 2008 financial crisis along with austerity measures a

nd other neoliberal policies have further eroded physical and mental well-being.

Poverty and substance use problems operate synergistically, at the extreme reinforced by psychiatric disorders and unstable housing.

A seminal National Academy of Sciences report provides this summary: ... While increased opioid prescribing for chronic pain has been a vector of the opioid epidemic,

researchers agree that such structural factors as lack of economic opportunity, poor working conditions, and eroded social capital in depressed communities,accompanied by hopelessness and despair, are root causes of the misuse of opioids and other substances...As with previous drug crises and the HIV epidemic, root causes are social and structural.

It is our duty to lend credence to these root causes and to advocate social change

Reply With Quote

Reply With Quote